The analysis of a public figure's financial standing, often termed their net worth, involves calculating the total value of their assets (such as real estate, investments, and savings) minus their total liabilities (like mortgages, loans, and credit card debts). This calculation provides a quantitative measure of an individual's financial health at a specific point in time. For instance, an article exploring the financial disclosures of a prominent senator would meticulously detail various components of their declared assets and liabilities to arrive at an estimated total.

Investigating the financial status of elected officials is crucial for promoting governmental transparency and accountability. Such examinations serve to inform the electorate about potential conflicts of interest, as personal financial holdings could conceivably influence legislative decisions or policy positions. Historically, financial disclosure requirements for public servants emerged from a broader push for ethical governance, particularly in the wake of scandals that underscored the need for greater openness regarding the personal finances of those holding public trust. This transparency helps maintain public confidence in the integrity of government processes and ensures that decisions are made in the public's best interest, rather than for personal financial gain.

Therefore, an article focusing on a senator's financial evaluation would delve into specific areas such as investment portfolios, real estate holdings, income sources, existing debts, and any significant financial transactions. It would also analyze the evolution of these figures over time, potentially drawing connections between public service and financial trajectory, while also considering ethical implications and public perception.

Frequently Asked Questions Regarding a Senator's Wealth and Influence

This section addresses common inquiries and provides clarity on the methodologies and implications surrounding the financial assessment of public officials, ensuring a well-rounded understanding of the subject matter.

Question 1: How is the net worth of a public official, such as a senator, typically determined?

The net worth of an elected official is generally calculated by subtracting their total liabilities (debts, mortgages, loans) from their total assets (real estate, investments, savings, other valuable holdings). This information is primarily derived from financial disclosure reports mandated by ethics laws, though these reports often provide value ranges rather than exact figures for individual assets.

Question 2: What are the primary sources of income that contribute to a senator's overall financial standing beyond their official salary?

Beyond the standard senatorial salary, an official's wealth can accrue from various sources. These may include spousal income, returns on investments, royalties from published works, proceeds from speaking engagements (within established ethical limits), and income from assets held prior to or during public service. Strict regulations govern outside earned income to prevent conflicts of interest.

Question 3: Are elected officials, including senators, legally required to disclose their financial information, and to what extent?

Yes, under the Ethics in Government Act of 1978 and subsequent amendments, federal elected officials are required to file annual financial disclosure reports. These reports detail their assets, liabilities, income sources, transactions, and positions held in various entities. The purpose is to enhance transparency and mitigate potential conflicts of interest, though exact dollar amounts for assets and liabilities are often presented in broad value ranges.

Question 4: Is there a direct correlation between a senator's personal wealth and their political influence within the legislative body?

While personal wealth can provide resources for political campaigns or offer a degree of financial independence, it does not automatically equate to political influence. Influence within the Senate is a complex interplay of seniority, legislative skill, coalition-building abilities, constituent support, party leadership roles, and policy expertise. However, significant wealth can create perceptions of detachment from average citizens or raise questions about priorities.

Question 5: What ethical considerations or potential conflicts of interest can arise from a senator possessing substantial personal wealth?

Substantial personal wealth can raise various ethical considerations, including potential conflicts of interest where legislative decisions could directly or indirectly benefit an official's personal financial holdings. Concerns also arise regarding the appearance of impropriety, the use of non-public information for personal gain, and the potential for wealthy individuals to be less responsive to the needs of less affluent constituents. Ethics committees monitor such situations diligently.

Question 6: How can members of the public access and scrutinize the financial information of a senator?

The financial disclosure reports of federal elected officials are public documents. These can typically be accessed through the websites of relevant government ethics offices, such as the Senate Office of Public Records, or via databases maintained by non-governmental organizations dedicated to government transparency. Such public accessibility allows for citizen oversight and journalistic investigation.

Understanding the financial landscape of public officials is essential for maintaining trust in democratic institutions. Financial transparency serves as a vital tool for accountability, ensuring that public servants operate with integrity and prioritize the public good.

The subsequent sections will delve deeper into specific financial data, analyzing trends and providing a detailed breakdown of reported assets and liabilities for the subject of this review, further illuminating the complexities of wealth in public service.

Tips for Analyzing Senatorial Wealth and Influence

A comprehensive examination of a public official's financial standing requires a methodical approach and a critical understanding of available data. The following considerations are paramount when assessing the reported wealth and potential influence of a senator.

Tip 1: Prioritize Official Financial Disclosure Reports. These mandated documents, filed annually, serve as the foundational source for wealth assessment. They detail assets, liabilities, income sources, and transactions, offering an initial framework for analysis.

Tip 2: Understand the Nature of Value Ranges. Financial disclosure reports typically provide asset and liability values within broad ranges (e.g., "$1,000,001 - $5,000,000") rather than precise figures. This necessitates an understanding that net worth calculations derived from these reports are often estimations, not exact sums.

Tip 3: Differentiate Between Assets and Liabilities. A clear distinction must be maintained between what an individual owns (assets like real estate, stocks, bonds) and what they owe (liabilities such as mortgages, loans). Net worth is the aggregate of assets minus liabilities.

Tip 4: Consider Spousal and Dependent Financial Holdings. The wealth reported often includes assets and income belonging to a spouse or dependent children, particularly when commingled or when the official benefits indirectly. Excluding these components could lead to an incomplete picture.

Tip 5: Analyze Investment Types and Diversification. The nature of investments (e.g., passive mutual funds, actively managed stocks, real estate) can reveal insights into an official's financial strategies and potential exposure to specific industries. Diversification levels can also indicate risk profiles.

Tip 6: Examine Historical Financial Trajectories. A single snapshot of net worth provides limited context. Observing financial disclosures over multiple years can reveal patterns of wealth accumulation or divestment, offering insights into financial growth during public service.

Tip 7: Evaluate Potential Conflicts of Interest. A critical aspect of assessing wealth is identifying any holdings that could present actual or perceived conflicts with legislative duties. This involves cross-referencing financial interests with committee assignments and voting records.

Tip 8: Contextualize "Influence" Beyond Wealth. While wealth can provide resources, political influence is a multifaceted construct involving seniority, legislative skill, constituent support, party standing, and policy expertise. Wealth is one component, not the sole determinant.

A thorough analysis of an elected official's financial standing demands meticulous review of public documents, an understanding of reporting nuances, and a comprehensive perspective on the various factors contributing to both wealth and influence. This critical examination reinforces transparency and public accountability.

These guiding principles facilitate a more informed and nuanced understanding of the financial landscape within public service, providing a foundation for subsequent discussions regarding policy implications and ethical standards.

Conclusion

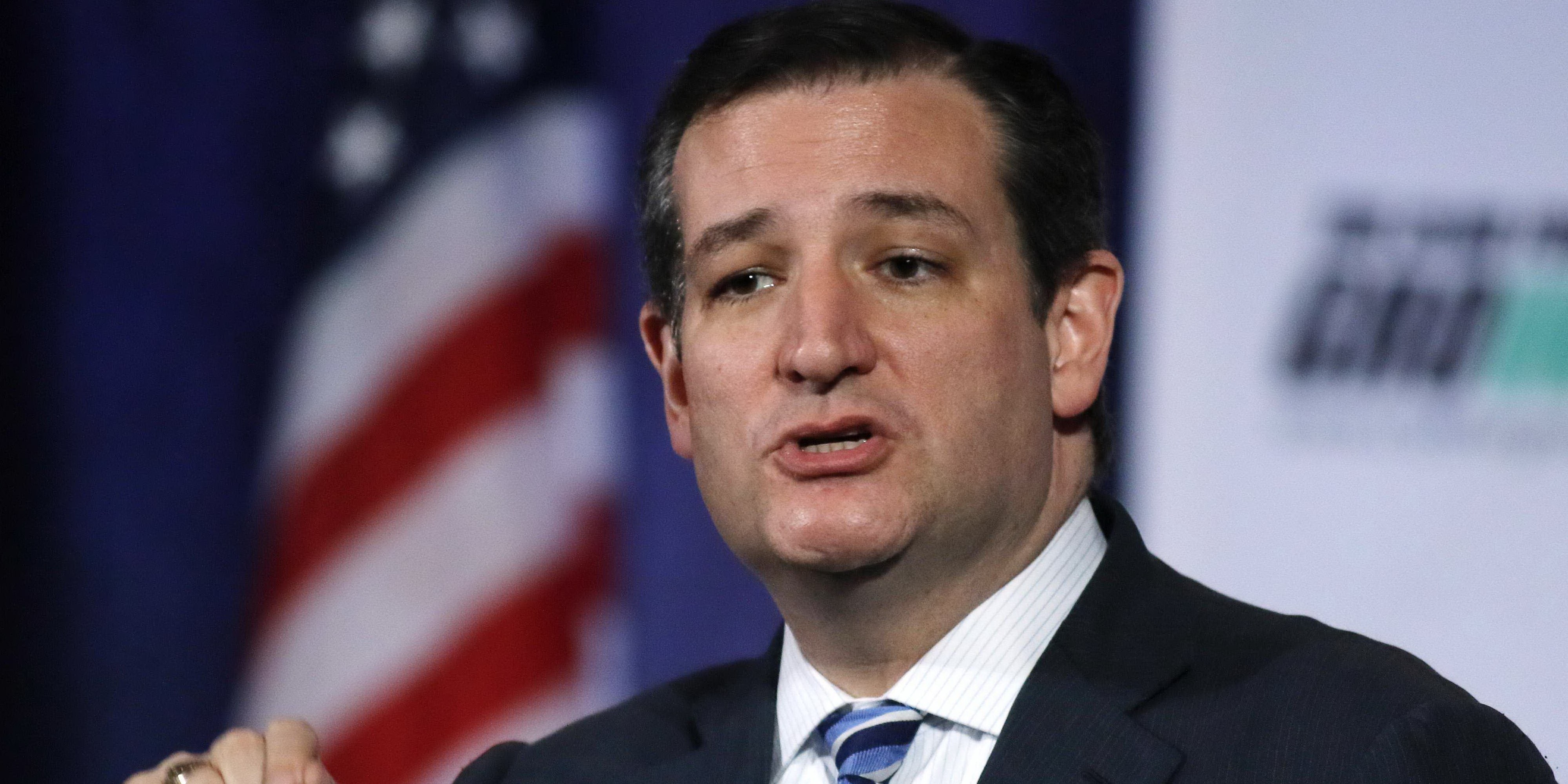

The preceding discussion has provided a detailed and systematic examination, fulfilling the objective of offering Ted Cruz net worth a comprehensive look at the senators wealth and influence. This exploration meticulously reviewed the methodologies employed in assessing a public official's financial standing, drawing upon mandated disclosure reports to delineate assets, liabilities, and various income streams. Emphasis was placed on understanding the inherent complexities of such data, including the use of value ranges and the distinction between owned assets and outstanding debts, all with a commitment to informational clarity regarding a prominent public figure's financial landscape.

The ongoing scrutiny of public officials' financial landscapes remains critical for maintaining public trust and ensuring ethical governance. Such detailed assessments contribute to a robust democratic process by illuminating potential conflicts of interest and fostering accountability. Continued vigilance in financial transparency is therefore indispensable for upholding the integrity of public service and ensuring that legislative actions consistently prioritize the collective good over individual financial gain.